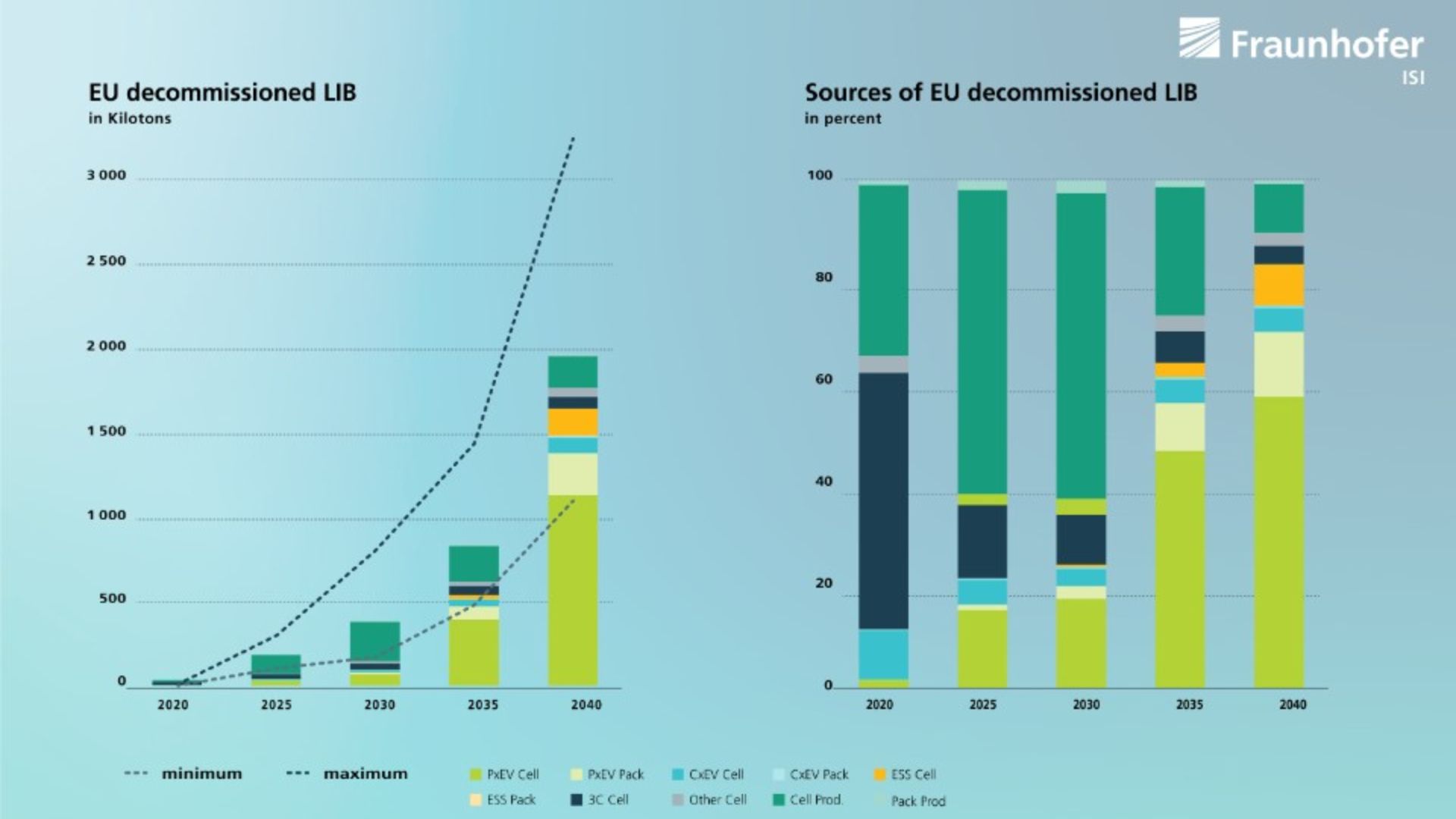

However, this number will change significantly in the coming years and is expected to reach ca. 420 kilotons in 2030 and up to 2100 kilotons in 20401. This rapid increase reflects the growing consumer shift to electric cars – which sales hit 10 million last year – a trend driven by the need to curb carbon emissions. According to a lifecycle analysis by France’s ADEME agency, full-life CO2 emissions from an Electric Vehicle (EV) are three to four times lower than for a comparable Internal Combustion Engine (ICE) vehicle2.

According to some studies, to reach the “net zero” the world needs approx. 2 billion EVs. The question is what will happen with the LiBs after they reach their end-of-life stage? The short answer is “recycling”, but the devil lies in the details. Follow along as we uncover the biggest challenges connected with LiB recycling and how packaging can support the management of its return flows.

Growing demand calls for global regulations

The demand for LiBs is growing and to satisfy the demand, global powerhouses are strengthening their production capacity. The European Battery Alliance, for instance, is spending €20 billion to support the building of 70 cell factory projects in 12 EU member states which are expected to produce between seven and eight million LiB batteries by 20253. The expansion, however, must go hand in hand with implementation of a comprehensive recycling strategy, because on average the batteries reach their end of life after 10 years (end of first life) or up to 15 years (second-life batteries). This means the clock is already ticking as the first large batches of used LiBs will reach their end-of-life stage around 2035. The main issue is though that LiBs contain highly toxic chemicals that represent a threat to ecosystems as well as to the people who handle them. In addition to plastics, solvents and electronic components, the active parts of battery cells also contain strategic metals such as copper, nickel, lithium, and cobalt. This means that recycling these components is an environmental and strategic imperative4.

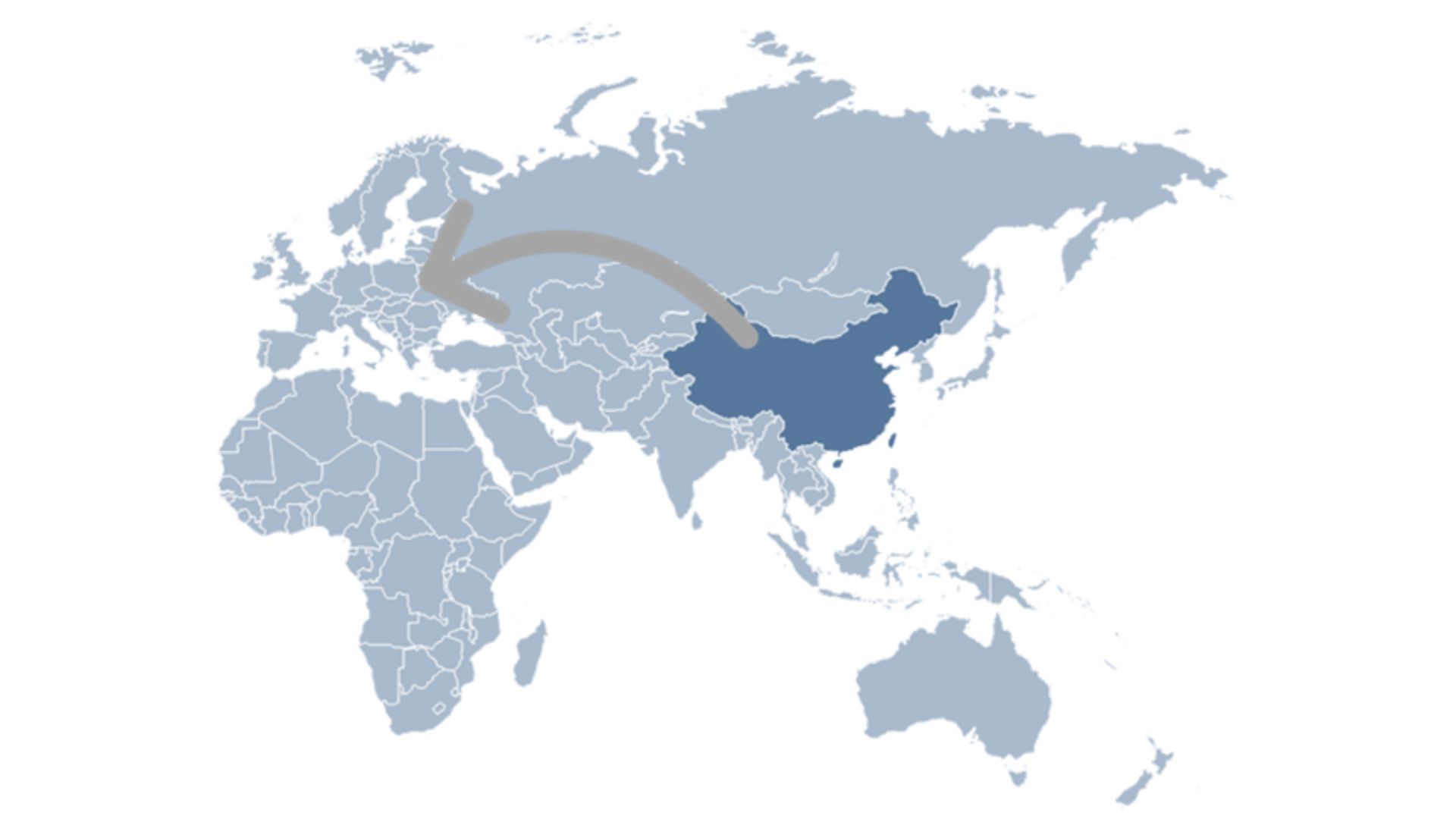

The supply chains are a global phenomenon, but the LiB recycling legislation is a patchwork of regionally determined rules loosely bound by global non-binding legislation. The European Battery Directive (2006/66/EC), for example, only mentions the obligations of the battery producers to recycle a minimum of 50% of total battery weight. Although the future plan is to increase this rate to 70% by 2030, including minimum of 90% of components classed as toxic or strategic, it only applies locally and for transcontinental shipments other regulations must be considered5. However, Japan, South Korea and China have already adopted similar regulations.

Another EU directive (2000/53/EC) sets environmental performance targets for end-of-life vehicles, i.e., to reuse and recycle at least 85% of the weight of end-of-life vehicles, and reuse or recover at least 95% of weight per vehicle. Batteries in fact represent 30% to 50% of vehicle weight and therefore their recovery and reuse are essential6. In the United States, the Inflation Reduction Act (IRA) strengthened domestic supply chains for EVs to qualify for clean vehicle tax credit. As a result, between August 2022 and March 2023, major EV battery makers invested ca. 52 billion USD in domestic battery manufacturing (50%), battery components (20%) and EV manufacturing (20%). The implementation of the recently proposed emissions standards from the US Environmental Protection Agency is set to further increase the 50% market share for electric cars in 20306.

Developing closed-loop for reusing and recycling LiBs

The overarching aim is to develop a truly global recycling loop for batteries in Europe to support the creation of a circular economy. To achieve this the European Commission for instance is currently drafting a new regulation that will impose the use of recycled materials in the composition of electric vehicle batteries. Starting in 2025, it will be mandatory to declare levels of recycled materials, irrespective of their place of manufacture. In 2030, the levels demanded will be 12% for cobalt, 4% for lithium and 4% for nickel, however, by 2035 they will rise to 20%, 10% and 12% respectively. This change will require a considerable increase in the amount of recycled material produced, and a major shift so that recycled by-products are re-routed back into new battery production processes. The overall efficiency of recycling rates will also be controlled via mandatory thresholds (2025: 90% for cobalt, copper, and nickel, and 35% for lithium; rising to 95% and 70% respectively in 2030)7.

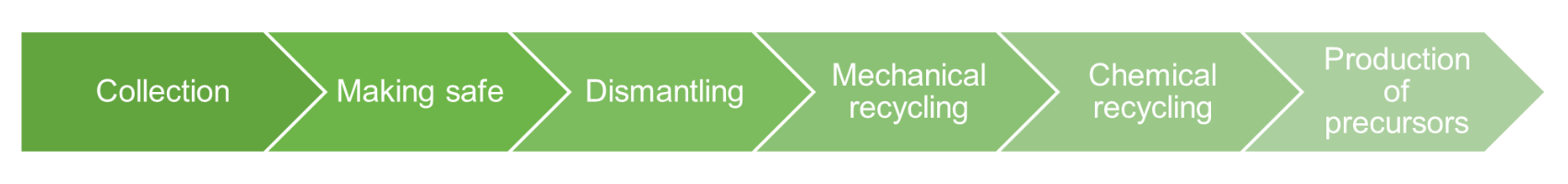

However, to retrieve as much valuable material from used LiBs as possible, the recycling process must follow strict rules and be handled by experienced personnel. That is in fact what makes the recycling process of EV batteries so complex and divides it into various stages, including collection (1), protection (2), dismantling (3), mechanical processing (grinding, 4), chemical processing (purifying, 5), and production of precursors (6). The first two steps usually take place at the automobile dealer site where the used battery is removed from the vehicle, discharged, examined and pre-diagnosed for potential re-use and repair. If it’s not usable anymore, it is dismantled (3) from the protective casing (made of aluminum or plastic), electronic components, wires, and connectors as well as the cooling system to locate the separate modules of the battery.

Once the aluminum protection around the modules is removed, the uncovered battery cells are ground up (4) to separate the valuable components under modified atmosphere to avoid the risk of fire or explosion. Once complete, the ground materials are mechanically separated to obtain “black mass”, a mixture of powdered carbon, nickel, lithium, and cobalt, which is then processed chemically (5) to purify the materials. If done correctly, the purified materials can be used in the production of new batteries (precursors) and the recycling loop is closed.

After 10 or 15 years of use, the EV batteries reach their end-of-life stage and need to undergo a complex recycling process to close the loop7.

Designing the optimal packaging solution for transporting LiBs

However, this doesn’t mean the battery’s journey ends here. Transporting both new, used and wasted battery material is a challenge also because of the various international rules and regulations for transporting dangerous goods. The UN issues separate guidelines (UN Recommendations on the Transport of Dangerous Goods) for transporting batteries for recycling based on three different statuses (commonly referred to as ‘green-yellow-red’) which indicate different technical requirements. Although the explanation behind the coloring seems intuitive (green for used or non-defective battery; yellow for non-critical battery and red for defective and likely to have a thermal reaction during shipment), the packaging constraints, required tests and handling precautions are very complex.

The regulations requirements on packaging vary depending on mode of transport as well as size and quantities of batteries. However, the goal remains the same - packaging solutions must prevent damage leading to dangerous situations. Securing batteries against short circuits and movement during transport are important parts of packaging design. To automate the packaging shipping process and reduce the use of resources, many automotive players implement returnable systems that can be utilized for several cycles. Thanks to its custom-design it helps automate handling, unloading, and packing, save labor time and improve workplace safety.

At Nefab we supply several hundreds of different packaging designs with UN certification in a wide range of materials with the focus on providing the most suitable solution for each individual project. Our products have been tested and certified for the transportation of Dangerous Goods in many different weights and sizes. All boxes are put through the required tests before they are approved for dangerous goods applications. The performed tests are conducted according to UN Recommendations as well as the specifications of other statutes. This way you can ensure your batteries are optimally protected against the unpredictable transit conditions and can arrive safely at their destination.

A UN certified returnable packaging for LiB cells or batteries designed for automated handling.

Want to learn more?

GET IN TOUCH

Contact us to learn more about our sustainable solutions.

LEARN MORE

GreenCALC

Nefab’s own certified calculator measures and quantifies financial and environmental savings in our solutions

Sustainable Solutions

Engineered packaging for sustainable supply chains

Sustainable Materials

Fiber-based packaging and raw materials